LONG TERM RENT

Housing Affordability Index: Mortgages in the Czech Republic Are Unlikely to Get Cheaper Soon

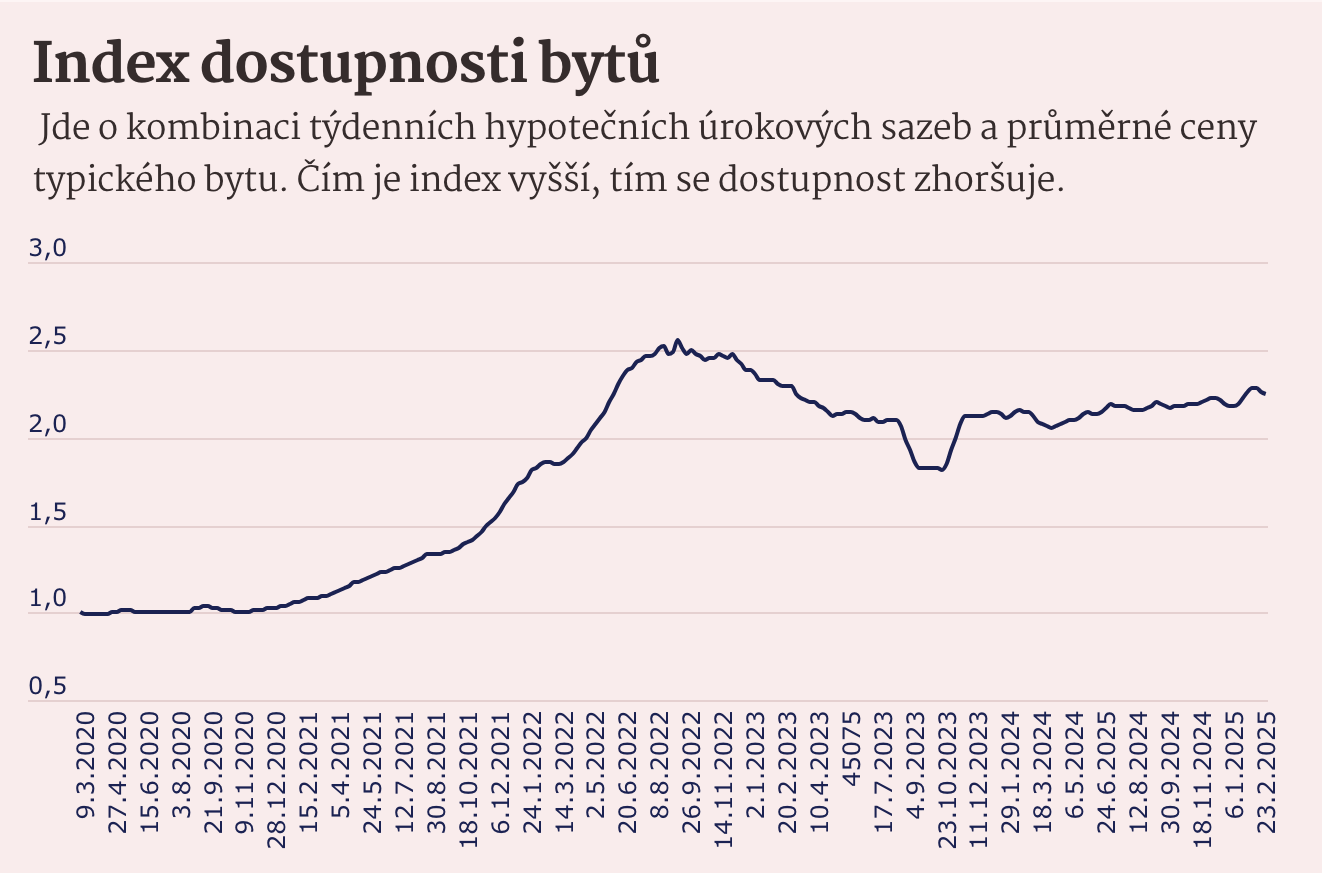

Since March 2020, the affordability of housing purchased with a mortgage in the Czech Republic has worsened by approximately 125%.

Despite a slight decrease in property prices, mortgage rates remain around 4.75%, which does not create conditions for significant price reductions.

Despite a slight decrease in property prices, mortgage rates remain around 4.75%, which does not create conditions for significant price reductions.

How Is the Index Calculated?

The Housing Affordability Index, developed by Seznam Zprávy based on data from EMA data, tracks market trends both nationwide and in individual regions. The calculations consider average property prices and current mortgage interest rates.

A key parameter is the monthly payment on a mortgage covering 80% of the cost of a 65 m² apartment, which corresponds to the average housing size in the Czech Republic according to the national statistics office.

The Housing Affordability Index, developed by Seznam Zprávy based on data from EMA data, tracks market trends both nationwide and in individual regions. The calculations consider average property prices and current mortgage interest rates.

A key parameter is the monthly payment on a mortgage covering 80% of the cost of a 65 m² apartment, which corresponds to the average housing size in the Czech Republic according to the national statistics office.

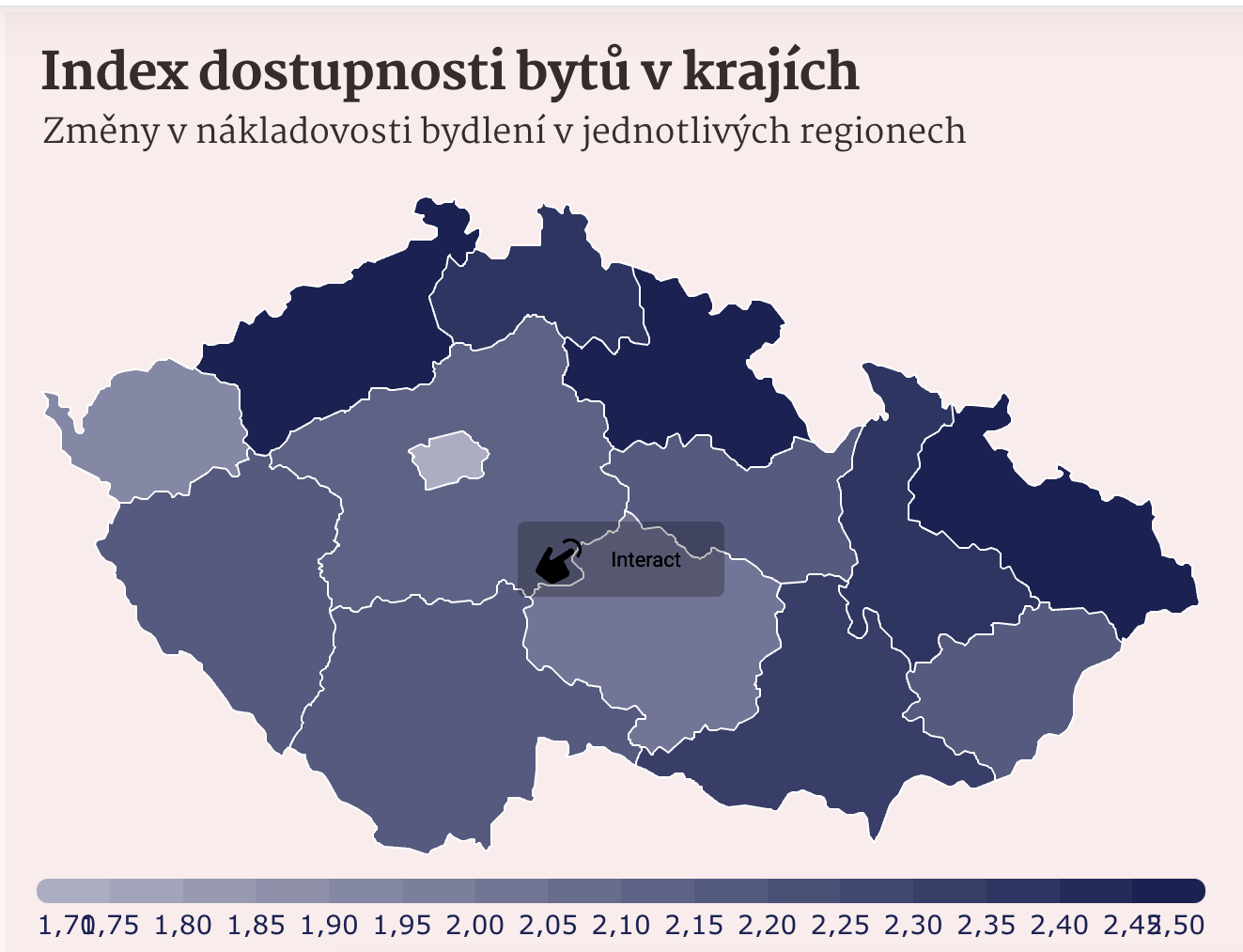

Prague remains the most challenging city for mortgage affordability, with an index value of 1.743, reflecting a 75% decline in affordability since March 2020.

The worst deterioration, however, is seen in the Hradec Králové region (2.644), surpassing the Ústí nad Labem region (2.518), which had long held the top spot for declining affordability.

In almost all Czech regions (except Prague and the Karlovy Vary region), the index now exceeds 2, meaning housing affordability via mortgages has more than halved since 2020.

Regional Differences

Mortgage Rates and Monthly Payments

Although property prices have slightly dropped, mortgage rates remain stable at around 4.75%.

Although property prices have slightly dropped, mortgage rates remain stable at around 4.75%.

This is mainly due to the fact that the cost of credit resources for banks has also remained unchanged, even increasing by 0.2 percentage points over the past three months. As a result, the Housing Affordability Index slightly improved compared to the previous week, decreasing by 0.4% to 2.254—the lowest level since late January.

The average mortgage payment varies by region. In Prague, the monthly installment is 35,403 CZK, in the South Moravian region it is 23,687 CZK, and in the Central Bohemian region it is 20,972 CZK. The most affordable mortgage payments remain in the Ústí nad Labem region, averaging 9,605 CZK per month.

The average mortgage payment varies by region. In Prague, the monthly installment is 35,403 CZK, in the South Moravian region it is 23,687 CZK, and in the Central Bohemian region it is 20,972 CZK. The most affordable mortgage payments remain in the Ústí nad Labem region, averaging 9,605 CZK per month.

Outlook for the Coming Months

In the near future, mortgage loans are unlikely to become cheaper. A potential rate reduction could occur only after the Czech National Bank’s board meeting on March 26, should they decide to lower the base interest rates. However, even if this happens, the impact on mortgage pricing would not be immediate, as banks consider multiple factors when setting interest rates.

In the near future, mortgage loans are unlikely to become cheaper. A potential rate reduction could occur only after the Czech National Bank’s board meeting on March 26, should they decide to lower the base interest rates. However, even if this happens, the impact on mortgage pricing would not be immediate, as banks consider multiple factors when setting interest rates.